Advertisement

-

Published Date

August 12, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

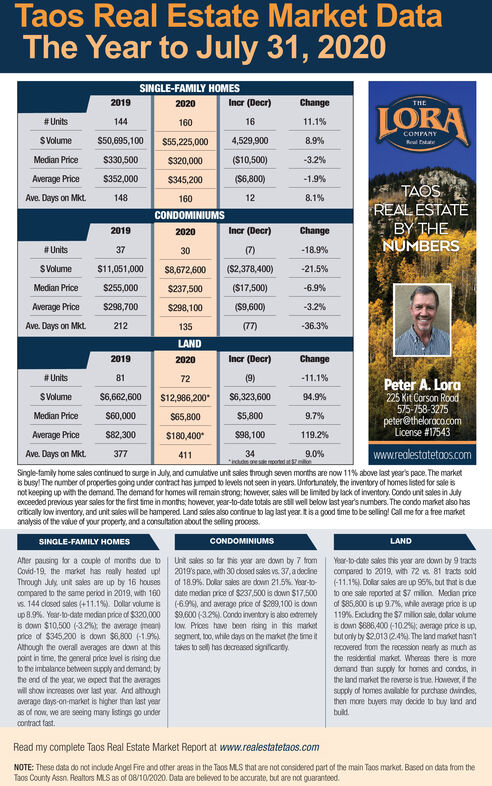

Taos Real Estate Market Data The Year to July 31, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE #Units 144 160 16 11.1% COMPANY Reul ta SVolume $50,695,100 $5,225,000 4,529,900 8.9% Median Price $330,500 $320,000 ($10,500) -3.2% Average Price $352,000 $345,200 ($6,800) -1.9% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 148 160 12 8.1% CONDOMINIUMS 2019 2020 Incr (Decr) Change #Units 37 30 (7) -18.9% SVolume $11,051,000 $8,672,600 ($2,378,400) -21.5% Median Price $255,000 $237,500 ($17,500) -6.9% Average Price $298,700 $298, 100 ($9,600) -3.2% Ave. Days on Mkt. 212 135 (77) -36.3% LAND 2019 2020 Incr (Decr) Change # Units 81 72 (9) -11.1% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $6,662,600 $12,986,200* $6,323,600 94.9% Median Price S60,000 S65,800 $5,800 9.7% Average Price $82,300 $180,400 $98,100 119.2% Ave. Days on Mkt. 377 411 34 9.0% www.realestatetaos.com Single-tamily home sales continued to surge in July, and cumulative unit sales through seven morths are now 11% above last year's pace. The market is busy! The number of properties going under contract has jumped to levels not seen in years. Unforturately, the inventory of homes listed for sale is not keeping up with the demand. The demand for homes will remain strong; however, sales will be limited by lack of inventory. Condo unit sales i ENceeded previcus year sales for the first ime in months, however, year-to-date totals are stil wel below last year's numbers. The condo market also has crtically low inventory, and unit sales will be hampered. Land sales also continue to lag last year. tis a good ime to be sellng! Call me for a free market analysis of the vlue of your property, and a consultation about the seling process. esin July SINGLE-FAMILY HOMES CONDOMINIUMS LAND Ater pousing for a couple of months due to | Unt sales so tar tis year are down by 7 fom Covid-19. the market has realy heated up! Through July, unit sales are up by 16 houses compared to the same period in 2019, with 160 s. 144 closed sales (+11.1%). Dolar volume is up8.9%. Year-to-date median price of $320,000 is down $10,500 (3.2%): the average mean) price of $345,200 is down $6.800 (-1.99%. Athough the overal averages are down at this point in time, the general price level is rising due o the imbalance between supply and demand; by the end of the year, we opect that the averages will show increases over last yoar. And although average days-on-market is higher than last year as of now, we are seeing many istings go under contract fast. Year-to date sales this year are down by 9 tracts compared to 2019, with 72 vs. 81 tracts sold 2019's pace, wth 30 dosed sales vs. 37, a decine of 18.9%. Dolar sales are down 21.5%. Year-o- date medan price of $237,500 is down $17,500 (-6.9%), and average price of $289,100 is down $0.600 (3.2%. Condo inventory is also edremely low. Prices have been rising in this market segment, loo, while days on the market the time it takes to sel has decreased signlficanty. (-11.1%). Doler sales are up 95%, but that is due to one sale reported at $7 milon. Medan price of $85,800 is up 9.7%, while average price is up 119%. Excluding the S7 milion sale, dolar volume is down $686,400 (-102%; average price is up. but orty by $2.013 24%). The land market hasn't recovered from the recession nearly as much as the residential market. Whereas there is more demand than supply for homes and condos, in the land market the reverse is true. Hovever, i the supply of homes avalable for purchase dwindes, then more buyers may decide to bay and and build. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 08/10/2020. Data are believed to be accurate, but are not guaranteed. Taos Real Estate Market Data The Year to July 31, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE #Units 144 160 16 11.1% COMPANY Reul ta SVolume $50,695,100 $5,225,000 4,529,900 8.9% Median Price $330,500 $320,000 ($10,500) -3.2% Average Price $352,000 $345,200 ($6,800) -1.9% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 148 160 12 8.1% CONDOMINIUMS 2019 2020 Incr (Decr) Change #Units 37 30 (7) -18.9% SVolume $11,051,000 $8,672,600 ($2,378,400) -21.5% Median Price $255,000 $237,500 ($17,500) -6.9% Average Price $298,700 $298, 100 ($9,600) -3.2% Ave. Days on Mkt. 212 135 (77) -36.3% LAND 2019 2020 Incr (Decr) Change # Units 81 72 (9) -11.1% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $6,662,600 $12,986,200* $6,323,600 94.9% Median Price S60,000 S65,800 $5,800 9.7% Average Price $82,300 $180,400 $98,100 119.2% Ave. Days on Mkt. 377 411 34 9.0% www.realestatetaos.com Single-tamily home sales continued to surge in July, and cumulative unit sales through seven morths are now 11% above last year's pace. The market is busy! The number of properties going under contract has jumped to levels not seen in years. Unforturately, the inventory of homes listed for sale is not keeping up with the demand. The demand for homes will remain strong; however, sales will be limited by lack of inventory. Condo unit sales i ENceeded previcus year sales for the first ime in months, however, year-to-date totals are stil wel below last year's numbers. The condo market also has crtically low inventory, and unit sales will be hampered. Land sales also continue to lag last year. tis a good ime to be sellng! Call me for a free market analysis of the vlue of your property, and a consultation about the seling process. esin July SINGLE-FAMILY HOMES CONDOMINIUMS LAND Ater pousing for a couple of months due to | Unt sales so tar tis year are down by 7 fom Covid-19. the market has realy heated up! Through July, unit sales are up by 16 houses compared to the same period in 2019, with 160 s. 144 closed sales (+11.1%). Dolar volume is up8.9%. Year-to-date median price of $320,000 is down $10,500 (3.2%): the average mean) price of $345,200 is down $6.800 (-1.99%. Athough the overal averages are down at this point in time, the general price level is rising due o the imbalance between supply and demand; by the end of the year, we opect that the averages will show increases over last yoar. And although average days-on-market is higher than last year as of now, we are seeing many istings go under contract fast. Year-to date sales this year are down by 9 tracts compared to 2019, with 72 vs. 81 tracts sold 2019's pace, wth 30 dosed sales vs. 37, a decine of 18.9%. Dolar sales are down 21.5%. Year-o- date medan price of $237,500 is down $17,500 (-6.9%), and average price of $289,100 is down $0.600 (3.2%. Condo inventory is also edremely low. Prices have been rising in this market segment, loo, while days on the market the time it takes to sel has decreased signlficanty. (-11.1%). Doler sales are up 95%, but that is due to one sale reported at $7 milon. Medan price of $85,800 is up 9.7%, while average price is up 119%. Excluding the S7 milion sale, dolar volume is down $686,400 (-102%; average price is up. but orty by $2.013 24%). The land market hasn't recovered from the recession nearly as much as the residential market. Whereas there is more demand than supply for homes and condos, in the land market the reverse is true. Hovever, i the supply of homes avalable for purchase dwindes, then more buyers may decide to bay and and build. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 08/10/2020. Data are believed to be accurate, but are not guaranteed.