Advertisement

-

Published Date

May 19, 2021This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

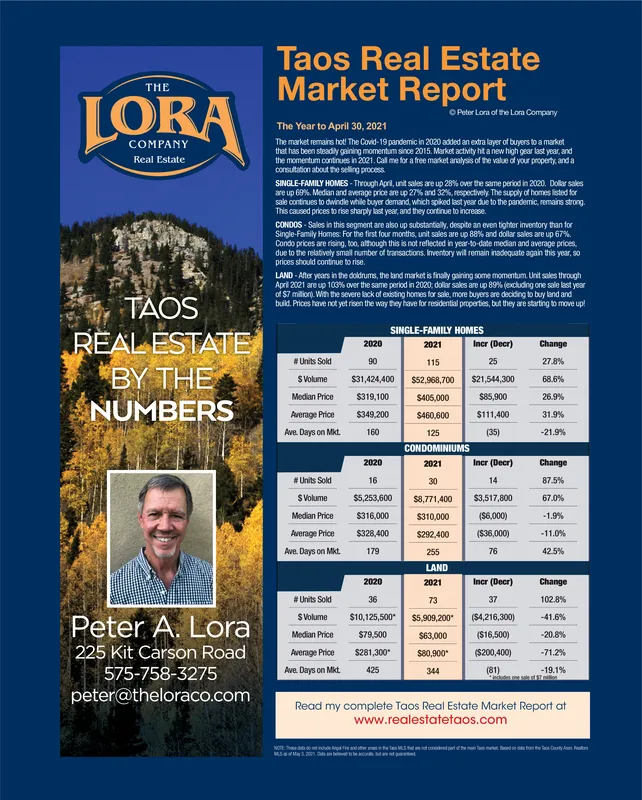

Taos Real Estate Market Report LORA THE OPeter Lora of the Lorna Company The Year to April 30, 2021 The market remains hot The Covid-19 pandemic in 2020 added an extra layer of buyers to a market that has been steadily gaining momentum since 2015. Market activity ht a new high gear last year, and the momentum continues in 2021. Call me for a free market analysis of the value of your property, and a COMPANY Real Estate consultation about the seling process. SINGLE-FAMILY HOMES - Through April, unit sales are up 28% over the same period in 2020. Dolar sales are up 69%. Median and average price are up 27% and 32%, respectively The supply of homes listed for sale continues to dwindle while buyer demand, which spiked last year due to the pandemic, remains strong. This caused prices to rise sharply last year, and they continue to increase. CONDOS - Sales in this segment are also up substantialy, despite an even tighter inventory than for Single-Family Homes: For the first four months, unit sales are up 88% and dollar sales are up 67%. Condo prices are rising, too, although this is not reflected in year-to-date median and average prices, due to the relatively small number of transactions. Inventory will remain inadequate again this year, so prices should continue to rise. LAND - After years in the doldrums, the kand market is finally gaining some momentum. Unit sales through April 2021 are up 103% over the same period in 2020; dollar sales are up 89% (excluding one sale last year of S7 milioni. With the severe lack of existing homes for sale, more buyers are deciding to buy land and build. Prices have not yet risen the way they have for residential properties, but they are starting to move up! TAOS REAL ESTATE BY THE NUMBERS SINGLE-FAMILY HOMES 2020 2021 Incr (Decr) Change # Units Sold 90 115 25 27.8% S Volume $31,424,400 $52,968,700 $21,544,300 68.6% Median Price $319,100 $405,000 $85,900 26.9% Average Price $349,200 $460,600 $111,400 31.9% Ave. Days on Mkt. 160 125 (35) -21.9% CONDOMINIUMS 2020 2021 Incr (Decr) Change # Units Sold 16 30 14 87.5% S Volume $5,253,600 $8,771,400 $3,517,800 67.0% Median Price $316,000 $310,000 ($6,000) -1.9% Average Price $328,400 $292,400 (S36,000) -11.0% Ave. Days on Mkt. 179 255 76 42.5% LAND 2020 2021 Incr (Decr) Change # Units Sold 36 73 37 102.8% SVolume $10,125,500 $5,909,200 ($4,216,300) -41.6% Peter A. Lora Median Price $79,500 $63,000 ($16,500) -20.8% 225 Kit Carson Road $281,300 Average Price S80,900 ($200,400) -71.2% 575-758-3275 Ave. Days on Mkt. 425 (81) ndudes one sale et tion -19.1% 344 peter@theloraco.com Read my complete Taos Real Estate Market Report at www.realestatetaos.com he tetuetan de No h Cy A tr M Ma Taos Real Estate Market Report LORA THE OPeter Lora of the Lorna Company The Year to April 30, 2021 The market remains hot The Covid-19 pandemic in 2020 added an extra layer of buyers to a market that has been steadily gaining momentum since 2015. Market activity ht a new high gear last year, and the momentum continues in 2021. Call me for a free market analysis of the value of your property, and a COMPANY Real Estate consultation about the seling process. SINGLE-FAMILY HOMES - Through April, unit sales are up 28% over the same period in 2020. Dolar sales are up 69%. Median and average price are up 27% and 32%, respectively The supply of homes listed for sale continues to dwindle while buyer demand, which spiked last year due to the pandemic, remains strong. This caused prices to rise sharply last year, and they continue to increase. CONDOS - Sales in this segment are also up substantialy, despite an even tighter inventory than for Single-Family Homes: For the first four months, unit sales are up 88% and dollar sales are up 67%. Condo prices are rising, too, although this is not reflected in year-to-date median and average prices, due to the relatively small number of transactions. Inventory will remain inadequate again this year, so prices should continue to rise. LAND - After years in the doldrums, the kand market is finally gaining some momentum. Unit sales through April 2021 are up 103% over the same period in 2020; dollar sales are up 89% (excluding one sale last year of S7 milioni. With the severe lack of existing homes for sale, more buyers are deciding to buy land and build. Prices have not yet risen the way they have for residential properties, but they are starting to move up! TAOS REAL ESTATE BY THE NUMBERS SINGLE-FAMILY HOMES 2020 2021 Incr (Decr) Change # Units Sold 90 115 25 27.8% S Volume $31,424,400 $52,968,700 $21,544,300 68.6% Median Price $319,100 $405,000 $85,900 26.9% Average Price $349,200 $460,600 $111,400 31.9% Ave. Days on Mkt. 160 125 (35) -21.9% CONDOMINIUMS 2020 2021 Incr (Decr) Change # Units Sold 16 30 14 87.5% S Volume $5,253,600 $8,771,400 $3,517,800 67.0% Median Price $316,000 $310,000 ($6,000) -1.9% Average Price $328,400 $292,400 (S36,000) -11.0% Ave. Days on Mkt. 179 255 76 42.5% LAND 2020 2021 Incr (Decr) Change # Units Sold 36 73 37 102.8% SVolume $10,125,500 $5,909,200 ($4,216,300) -41.6% Peter A. Lora Median Price $79,500 $63,000 ($16,500) -20.8% 225 Kit Carson Road $281,300 Average Price S80,900 ($200,400) -71.2% 575-758-3275 Ave. Days on Mkt. 425 (81) ndudes one sale et tion -19.1% 344 peter@theloraco.com Read my complete Taos Real Estate Market Report at www.realestatetaos.com he tetuetan de No h Cy A tr M Ma