Advertisement

-

Published Date

December 9, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

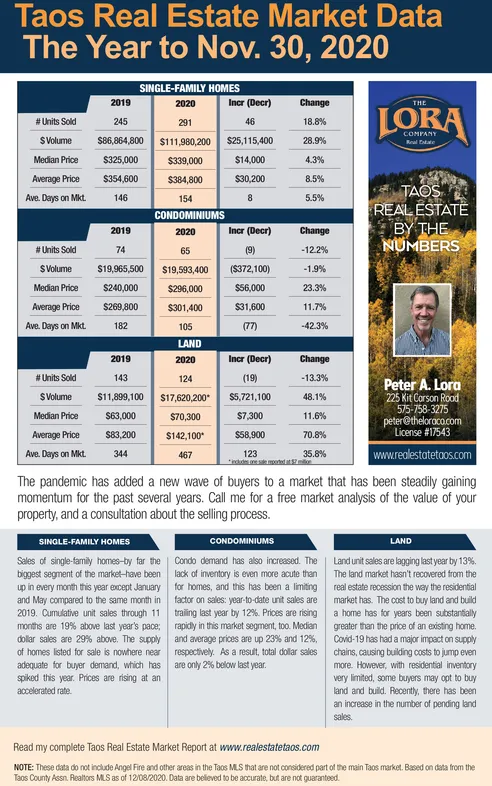

Taos Real Estate Market Data The Year to Oct. 31, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE # Units Sold 217 263 46 21.2% SVolume S76,940,300 COMPANY Reul ta $98,060,000 $21,119,700 27.4% Median Price S330,000 $327,000 ($3,000) -0.9% Average Price $354,600 $372,900 $18,300 5.2% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 150 154 4 2.7% CONDOMINIUMS 2019 2020 Incr (Decr) Change # Units Sold 65 61 (4) -6.2% SVolume $17,892,500 $18,579,400 $686,900 3.8% Median Price $241,300 $299,000 $57,700 23.9% Average Price $275,300 $304,600 29,300 10.6% Ave. Days on Mkt. 168 110 (58) -34.5% LAND 2019 2020 Incr (Decr) Change # Units Sold 134 117 (17) -12.7% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $10,586,900 $17,052,200* $6,465,300 61.1% Median Price $62,800 $70,500 $7,700 12.3% Average Price $79,000 $145,700 $66,700 84.4% Ave. Days on Mkt. 337 125 ade ese motet at 37.1% www.realestatetaos.com 462 The pandemic has added a new wave of buyers to a market that has been steadily gaining momentum for the past several years. Call me for a free market analysis of the value of your property, and a consultation about the selling process. SINGLE-FAMILY HOMES CONDOMINIUMS LAND The market continued strong in October. | Condo demand has also increased, but the Land unit sales are lagging last year by 13%. Sales of single-family homes-by far the lack of inventory is even more acute than biggest segment of the market--have been for homes, and this has been a limiting up in every month this year except January factor on sales: year-to-date unit sales are and May compared to the same month in 2019. Cumulative unit sales through 10 months are 21% above last year's pace; The land market hasn't recovered from the real estate recession like the residential market has. The cost to buy land and build a home has for years been substantially greater than the price of an existing home. Covid-19 has had a major impact on supply 6% fewer than last year. Prices are rising rapidly in this market segment, too. Total dollar sales are 4% greater than last year; dollar sales are 27% above. The inventory of median and average prices are up 24% and homes listed for sale is not keeping up with surging buyer demand. Prices are rising at chains, causing buikding costs to jump even more. However, with residential inventory very limited, some buyers may opt to buy land and build. Recently, there has been an increase in the number of pending land 11%, respectively. an accelerated rate in a hot seller's market. sales. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 11/21/2020. Data are believed to be accurate, but are not guaranteed. Taos Real Estate Market Data The Year to Oct. 31, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE # Units Sold 217 263 46 21.2% SVolume S76,940,300 COMPANY Reul ta $98,060,000 $21,119,700 27.4% Median Price S330,000 $327,000 ($3,000) -0.9% Average Price $354,600 $372,900 $18,300 5.2% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 150 154 4 2.7% CONDOMINIUMS 2019 2020 Incr (Decr) Change # Units Sold 65 61 (4) -6.2% SVolume $17,892,500 $18,579,400 $686,900 3.8% Median Price $241,300 $299,000 $57,700 23.9% Average Price $275,300 $304,600 29,300 10.6% Ave. Days on Mkt. 168 110 (58) -34.5% LAND 2019 2020 Incr (Decr) Change # Units Sold 134 117 (17) -12.7% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $10,586,900 $17,052,200* $6,465,300 61.1% Median Price $62,800 $70,500 $7,700 12.3% Average Price $79,000 $145,700 $66,700 84.4% Ave. Days on Mkt. 337 125 ade ese motet at 37.1% www.realestatetaos.com 462 The pandemic has added a new wave of buyers to a market that has been steadily gaining momentum for the past several years. Call me for a free market analysis of the value of your property, and a consultation about the selling process. SINGLE-FAMILY HOMES CONDOMINIUMS LAND The market continued strong in October. | Condo demand has also increased, but the Land unit sales are lagging last year by 13%. Sales of single-family homes-by far the lack of inventory is even more acute than biggest segment of the market--have been for homes, and this has been a limiting up in every month this year except January factor on sales: year-to-date unit sales are and May compared to the same month in 2019. Cumulative unit sales through 10 months are 21% above last year's pace; The land market hasn't recovered from the real estate recession like the residential market has. The cost to buy land and build a home has for years been substantially greater than the price of an existing home. Covid-19 has had a major impact on supply 6% fewer than last year. Prices are rising rapidly in this market segment, too. Total dollar sales are 4% greater than last year; dollar sales are 27% above. The inventory of median and average prices are up 24% and homes listed for sale is not keeping up with surging buyer demand. Prices are rising at chains, causing buikding costs to jump even more. However, with residential inventory very limited, some buyers may opt to buy land and build. Recently, there has been an increase in the number of pending land 11%, respectively. an accelerated rate in a hot seller's market. sales. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 11/21/2020. Data are believed to be accurate, but are not guaranteed.