Advertisement

-

Published Date

June 23, 2021This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

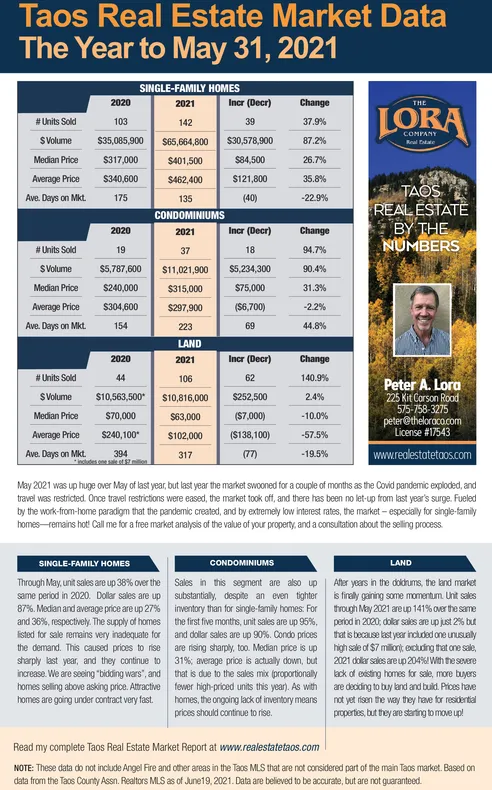

Taos Real Estate Market Data The Year to May 31, 2021 SINGLE-FAMILY HOMES 2020 2021 Incr (Decr) Change LORA THE # Units Sold 103 142 39 37.9% COMPANY SVolume $35,085,900 $65,664,800 S30,578,900 87.2% Real ta Median Price $317,000 $401,500 $84,500 26.7% Average Price $340,600 $462,400 $121,800 35.8% TAOS REALESTATE BY THE NUMBERS Ave. Days on Mkt. 175 135 (40) -22.9% CONDOMINIUMS 2020 2021 Incr (Decr) Change #Units Sold 19 37 18 94.7% SVolume $5,787,600 $11,021,900 $5,234,300 90.4% Median Price $240,000 $315,000 $75,000 31.3% Average Price $304,600 $297,900 (S6,700) -2.2% Ave. Days on Mkt. 154 223 69 44.8% LAND 2020 2021 Incr (Decr) Change # Units Sold 44 106 62 140.9% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraco.com License #17543 SVolume $10,563,500 $10,816,000 $252,500 2.4% Median Price S70,000 $63,000 ($7,000) -10.0% Average Price $240,100" $102,000 ($138,100) -57.5% Ave. Days on Mkt. 394 tes one sae et llon www.realestatetaos.com 317 (77) -19.5% May 2021 was up huge over May of last year, but last year the market swooned for a couple of months as the Covid pandemic exploded, and travel was restricted. Once travel restrictions were eased, the market took off, and there has been no let-up from last year's surge. Fueled by the work-from-home paradigm that the pandemic created, and by extremely low interest rates, the market - especially for single-family homes-remains hot! Call me for a free market analysis of the value of your property, and a consultation about the selling process. LAND SINGLE-FAMILY HOMES CONDOMINIUMS After years in the dolhums, the and market is firaly gaining some momentum. Unt sales inventory than for singe-family homes: For trough May 2021 are up 141% over the same and 36%, respectively. The supply of homes the first five months, unit sales are up 95%, perod in 2020, dolar sales are up just 2% but that is because kast year incuded one unusualy high sale of $7 milionit ecding trat one sale, 2021 dolar sales are up 204% With the severe Through May, unit sales are up 38% over the Sales in this segment are also up same period in 2020. Dollar sales are up substantially, despite an even tighter 87%. Median and average price are up 27% isted for sale remains very inadequate for the demand. This caused prices to rise and dollar sales are up 90%. Condo prices are rising sharply, to0. Median price is up 31%; average price is actually down, but increase. We are seeing "bidding wars", and that is due to the sales mix (proportionally homes seling above asking price. Atractive fewer high-priced units this year). As with homes, the ongoing lack of inventory means sharply last year, and they continue to lack of eisting homes for sale, more buyers are deciding to buy land and buld. Prces have not yet risen the way they have for residential propertes, but they are starting o move up! homes are going under contract very fast. prices should continue to rise. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Tacs MLS that are not considered part of the main Taos market. Based on data from the Tacs County Assn. Realtors MLS as of June19, 2021. Data are believed to be accurate, but are not guaranteed. Taos Real Estate Market Data The Year to May 31, 2021 SINGLE-FAMILY HOMES 2020 2021 Incr (Decr) Change LORA THE # Units Sold 103 142 39 37.9% COMPANY SVolume $35,085,900 $65,664,800 S30,578,900 87.2% Real ta Median Price $317,000 $401,500 $84,500 26.7% Average Price $340,600 $462,400 $121,800 35.8% TAOS REALESTATE BY THE NUMBERS Ave. Days on Mkt. 175 135 (40) -22.9% CONDOMINIUMS 2020 2021 Incr (Decr) Change #Units Sold 19 37 18 94.7% SVolume $5,787,600 $11,021,900 $5,234,300 90.4% Median Price $240,000 $315,000 $75,000 31.3% Average Price $304,600 $297,900 (S6,700) -2.2% Ave. Days on Mkt. 154 223 69 44.8% LAND 2020 2021 Incr (Decr) Change # Units Sold 44 106 62 140.9% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraco.com License #17543 SVolume $10,563,500 $10,816,000 $252,500 2.4% Median Price S70,000 $63,000 ($7,000) -10.0% Average Price $240,100" $102,000 ($138,100) -57.5% Ave. Days on Mkt. 394 tes one sae et llon www.realestatetaos.com 317 (77) -19.5% May 2021 was up huge over May of last year, but last year the market swooned for a couple of months as the Covid pandemic exploded, and travel was restricted. Once travel restrictions were eased, the market took off, and there has been no let-up from last year's surge. Fueled by the work-from-home paradigm that the pandemic created, and by extremely low interest rates, the market - especially for single-family homes-remains hot! Call me for a free market analysis of the value of your property, and a consultation about the selling process. LAND SINGLE-FAMILY HOMES CONDOMINIUMS After years in the dolhums, the and market is firaly gaining some momentum. Unt sales inventory than for singe-family homes: For trough May 2021 are up 141% over the same and 36%, respectively. The supply of homes the first five months, unit sales are up 95%, perod in 2020, dolar sales are up just 2% but that is because kast year incuded one unusualy high sale of $7 milionit ecding trat one sale, 2021 dolar sales are up 204% With the severe Through May, unit sales are up 38% over the Sales in this segment are also up same period in 2020. Dollar sales are up substantially, despite an even tighter 87%. Median and average price are up 27% isted for sale remains very inadequate for the demand. This caused prices to rise and dollar sales are up 90%. Condo prices are rising sharply, to0. Median price is up 31%; average price is actually down, but increase. We are seeing "bidding wars", and that is due to the sales mix (proportionally homes seling above asking price. Atractive fewer high-priced units this year). As with homes, the ongoing lack of inventory means sharply last year, and they continue to lack of eisting homes for sale, more buyers are deciding to buy land and buld. Prces have not yet risen the way they have for residential propertes, but they are starting o move up! homes are going under contract very fast. prices should continue to rise. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Tacs MLS that are not considered part of the main Taos market. Based on data from the Tacs County Assn. Realtors MLS as of June19, 2021. Data are believed to be accurate, but are not guaranteed.