Advertisement

-

Published Date

October 8, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

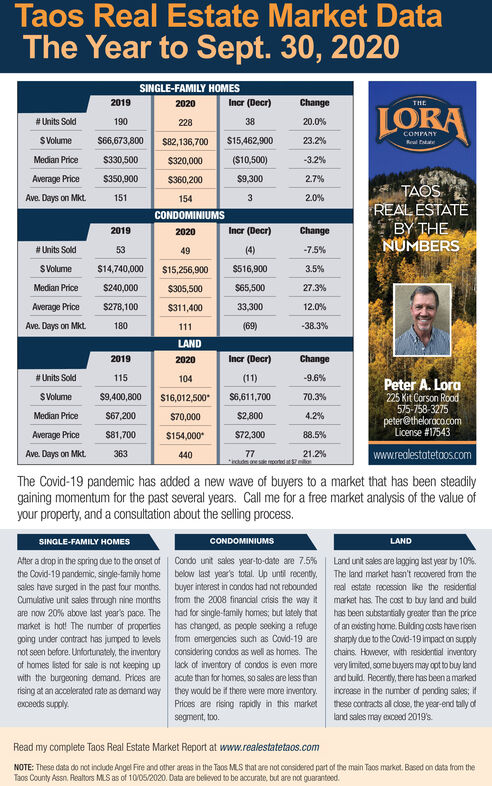

Taos Real Estate Market Data The Year to Sept. 30, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE # Units Sold 190 228 38 20.0% SVolume S66,673,800 $15,462,900 COMPANY Reul ta $82,136,700 23.2% Median Price $330,500 $320,000 ($10,500) -3.2% Average Price $350,900 $360,200 $9,300 2.7% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 151 154 3 2.0% CONDOMINIUMS 2019 2020 Incr (Decr) Change # Units Sold 53 49 (4) -7.5% SVolume $14,740,000 $15,256,900 $516,900 3.5% Median Price $240,000 $305,500 $65,500 27.3% Average Price $278,100 $311,400 33,300 12.0% Ave. Days on Mkt. 180 111 (69) -38.3% LAND 2019 2020 Incr (Decr) Change # Units Sold 115 104 (11) -9.6% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $9,400,800 $16,012,500 $6,611,700 70.3% Median Price $67,200 $70,000 $2,800 4.2% Average Price S81,700 $154,000* $72,300 88.5% Ave. Days on Mkt. 363 77 *ds e mondat o 21.2% www.realestatetaos.com 440 The Covid-19 pandemic has added a new wave of buyers to a market that has been steadily gaining momentum for the past several years. Call me for a free market analysis of the value of your property, and a consultation about the selling process. SINGLE-FAMILY HOMES CONDOMINIUMS LAND After a drop in the spring due to the onset of | Condo unit sales year-to-date are 7.5% the Covid-19 pandemic, single-family home below last year's total. Up unti recenty, sales have surged in the past four months. buyer interest in condos had not rebounded Cumulative unit sales through nine months from the 2008 financial crisis the way it are now 20% above last year's pace. The Land unit sales are lagging last year by 10%. The land market hasn't recovered from the real estate recession like the residential market has. The cost to buy land and build has been substantialy greater than the price had for single-family homes; but lately that market is hot! The number of properties has changed, as people seeking a refuge going under contract has jumped to levels not seen before. Unfortunately, the inventory considering condos as well as homes. The of an existing home. Bulding costs have risen sharply due to the Covid-19 impact on supply from emergencies such as Covid-19 are of homes isted for sale is not keeping up lack of inventory of condos is even more with the burgeoning demand. Prices are acute than for homes, so sales are less than rising at an accelerated rate as demand way they would be if there were more inventory. exceeds supply. chains. However, with residential inventory very limited, some buyers may opt to buy land and build. Recently, there has been a marked increase in the number of pending sales; if these contracts all dose, the year-end tally of land sales may exceed 2019's. Prices are rising rapidly in this market segment, too. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 10/05/2020. Data are believed to be accurate, but are not guaranteed. Taos Real Estate Market Data The Year to Sept. 30, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE # Units Sold 190 228 38 20.0% SVolume S66,673,800 $15,462,900 COMPANY Reul ta $82,136,700 23.2% Median Price $330,500 $320,000 ($10,500) -3.2% Average Price $350,900 $360,200 $9,300 2.7% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 151 154 3 2.0% CONDOMINIUMS 2019 2020 Incr (Decr) Change # Units Sold 53 49 (4) -7.5% SVolume $14,740,000 $15,256,900 $516,900 3.5% Median Price $240,000 $305,500 $65,500 27.3% Average Price $278,100 $311,400 33,300 12.0% Ave. Days on Mkt. 180 111 (69) -38.3% LAND 2019 2020 Incr (Decr) Change # Units Sold 115 104 (11) -9.6% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $9,400,800 $16,012,500 $6,611,700 70.3% Median Price $67,200 $70,000 $2,800 4.2% Average Price S81,700 $154,000* $72,300 88.5% Ave. Days on Mkt. 363 77 *ds e mondat o 21.2% www.realestatetaos.com 440 The Covid-19 pandemic has added a new wave of buyers to a market that has been steadily gaining momentum for the past several years. Call me for a free market analysis of the value of your property, and a consultation about the selling process. SINGLE-FAMILY HOMES CONDOMINIUMS LAND After a drop in the spring due to the onset of | Condo unit sales year-to-date are 7.5% the Covid-19 pandemic, single-family home below last year's total. Up unti recenty, sales have surged in the past four months. buyer interest in condos had not rebounded Cumulative unit sales through nine months from the 2008 financial crisis the way it are now 20% above last year's pace. The Land unit sales are lagging last year by 10%. The land market hasn't recovered from the real estate recession like the residential market has. The cost to buy land and build has been substantialy greater than the price had for single-family homes; but lately that market is hot! The number of properties has changed, as people seeking a refuge going under contract has jumped to levels not seen before. Unfortunately, the inventory considering condos as well as homes. The of an existing home. Bulding costs have risen sharply due to the Covid-19 impact on supply from emergencies such as Covid-19 are of homes isted for sale is not keeping up lack of inventory of condos is even more with the burgeoning demand. Prices are acute than for homes, so sales are less than rising at an accelerated rate as demand way they would be if there were more inventory. exceeds supply. chains. However, with residential inventory very limited, some buyers may opt to buy land and build. Recently, there has been a marked increase in the number of pending sales; if these contracts all dose, the year-end tally of land sales may exceed 2019's. Prices are rising rapidly in this market segment, too. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 10/05/2020. Data are believed to be accurate, but are not guaranteed.