Advertisement

-

Published Date

August 27, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

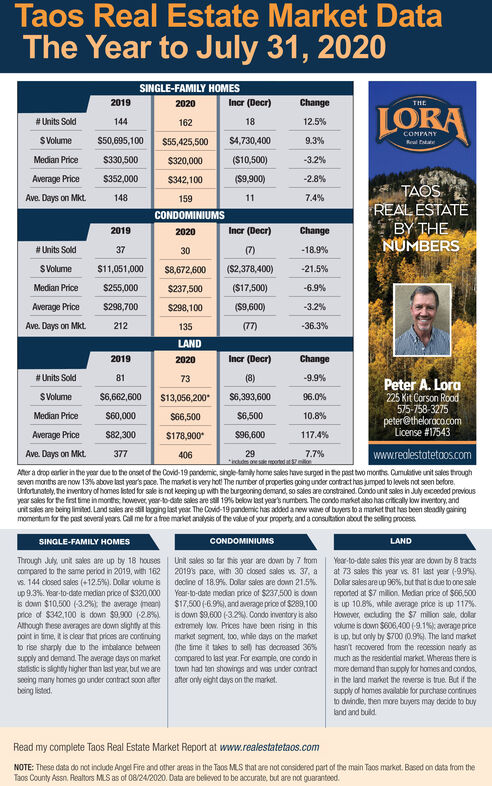

Real Estate Market Data Taos The Year to July 31, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE # Units Sold 144 162 18 12.5% SVolume $50,695,100 $4,730,400 COMPANY Reul ta $5,425,500 9.3% Median Price $330,500 $320,000 ($10,500) -3.2% Average Price $352,000 $342,100 ($9,900) -2.8% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 148 159 11 7.4% CONDOMINIUMS 2019 2020 Incr (Decr) Change # Units Sold 37 30 (7) -18.9% SVolume $11,051,000 $8,672,600 ($2,378,400) -21.5% Median Price $255,000 $237,500 ($17,500) -6.9% Average Price $298,700 $298, 100 ($9,600) -3.2% Ave. Days on Mkt. 212 135 (77) -36.3% LAND 2019 2020 Incr (Decr) Change # Units Sold 81 73 (8) -9.9% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $6,662,600 $13,056,200 $6,393,600 96.0% Median Price S60,000 $66,500 $6,500 10.8% Average Price $82,300 $178,900* $96,600 117.4% Ave. Days on Mkt. 377 29 des o se moned at o 7.7% www.realestatetaos.com 406 Ater a drop earlier in the year due to the onset of the Covid-19 pandemic, single-tamly home sales have surged in the past two months. Cumukative unit sales through seven montrs are now 13% above last year's pace. The market is very hot The number of properties going under contract has jumped to levels not seen before, Untortunately, he inventory of homes isted for sale s not keeping up with the burgeoring demand, so sales are constrained. Condo unt sales in July exceeded previcus year sales for the first time in montrs, however year-to-date sales are st 19% below kast year's numbers. The condo market also has critically kow invertory, and unit sales are being limited. Land sales are stil kagging last year The Covid-19 pandemic has added a new wave of buyers to a market that hes been steadily gaining momentum for the past several years. Call me for a free market analysis of the value of your property and a consultation about the seling process SINGLE-FAMILY HOMES CONDOMINIUMS LAND Through July, unt sales are up by 18 houses compared to the same period in 2019, with 162 2019s pace, with 30 dosed sales s. 37, a s. 144 closed sales (+12.5%). Dolar volume is up 9.3%. Year-to-date median price of $320,000 is down $10,500 (3.2% the average mean) price of $342,100 is down $9.900 (28%). Although these averages are down slighty at this point in time, t is clear that prices are contiruing to rise sharply due to the imbalance between supply and demand. The average days on market statistic is sighty higher than kast year, but we are soeing many homes go under contract s0on after being listed. Year-to-date sales this year are down by B tracts at 73 sales this year vs. 81 last year (-9.9). Dolar sales are up 96%, but that is due to one sale reported at $7 milon. Median price of S06,500 is up 10.8%, while average price is up 117%. However, excuding the $7 milion sale, dollar volume is down $606,400 (9.1%: average price is up, but only by $700 (0.9%). The land markot hasn't recovered from the recession nearly as Unit sales so far this year are down by 7 trom decine of 18.9%. Dolar sales are down 21.5%. Year-to-date median price of $237,500 is down $17,500 (-6.9%), and average prios of $289,100 is down $9,600 (-32%. Condo inventory is also extremely low. Prices have been rising in this market segment, too, while days on the market (the ime it takes to sel) has decreased 36% compared to last year. For example, one condo in town had ten showings and was under contract aftler orly eight days on the market. much as the residential market. Whereas there is more demand than supply for homes and condos, in the land market the reverse is true. But if the supply of homes available for purchase continues to dwinde, then more buyers may decide to buy land and buld Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 08/24/2020. Data are believed to be accurate, but are not guaranteed. Real Estate Market Data Taos The Year to July 31, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE # Units Sold 144 162 18 12.5% SVolume $50,695,100 $4,730,400 COMPANY Reul ta $5,425,500 9.3% Median Price $330,500 $320,000 ($10,500) -3.2% Average Price $352,000 $342,100 ($9,900) -2.8% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 148 159 11 7.4% CONDOMINIUMS 2019 2020 Incr (Decr) Change # Units Sold 37 30 (7) -18.9% SVolume $11,051,000 $8,672,600 ($2,378,400) -21.5% Median Price $255,000 $237,500 ($17,500) -6.9% Average Price $298,700 $298, 100 ($9,600) -3.2% Ave. Days on Mkt. 212 135 (77) -36.3% LAND 2019 2020 Incr (Decr) Change # Units Sold 81 73 (8) -9.9% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraca.com License #17543 SVolume $6,662,600 $13,056,200 $6,393,600 96.0% Median Price S60,000 $66,500 $6,500 10.8% Average Price $82,300 $178,900* $96,600 117.4% Ave. Days on Mkt. 377 29 des o se moned at o 7.7% www.realestatetaos.com 406 Ater a drop earlier in the year due to the onset of the Covid-19 pandemic, single-tamly home sales have surged in the past two months. Cumukative unit sales through seven montrs are now 13% above last year's pace. The market is very hot The number of properties going under contract has jumped to levels not seen before, Untortunately, he inventory of homes isted for sale s not keeping up with the burgeoring demand, so sales are constrained. Condo unt sales in July exceeded previcus year sales for the first time in montrs, however year-to-date sales are st 19% below kast year's numbers. The condo market also has critically kow invertory, and unit sales are being limited. Land sales are stil kagging last year The Covid-19 pandemic has added a new wave of buyers to a market that hes been steadily gaining momentum for the past several years. Call me for a free market analysis of the value of your property and a consultation about the seling process SINGLE-FAMILY HOMES CONDOMINIUMS LAND Through July, unt sales are up by 18 houses compared to the same period in 2019, with 162 2019s pace, with 30 dosed sales s. 37, a s. 144 closed sales (+12.5%). Dolar volume is up 9.3%. Year-to-date median price of $320,000 is down $10,500 (3.2% the average mean) price of $342,100 is down $9.900 (28%). Although these averages are down slighty at this point in time, t is clear that prices are contiruing to rise sharply due to the imbalance between supply and demand. The average days on market statistic is sighty higher than kast year, but we are soeing many homes go under contract s0on after being listed. Year-to-date sales this year are down by B tracts at 73 sales this year vs. 81 last year (-9.9). Dolar sales are up 96%, but that is due to one sale reported at $7 milon. Median price of S06,500 is up 10.8%, while average price is up 117%. However, excuding the $7 milion sale, dollar volume is down $606,400 (9.1%: average price is up, but only by $700 (0.9%). The land markot hasn't recovered from the recession nearly as Unit sales so far this year are down by 7 trom decine of 18.9%. Dolar sales are down 21.5%. Year-to-date median price of $237,500 is down $17,500 (-6.9%), and average prios of $289,100 is down $9,600 (-32%. Condo inventory is also extremely low. Prices have been rising in this market segment, too, while days on the market (the ime it takes to sel) has decreased 36% compared to last year. For example, one condo in town had ten showings and was under contract aftler orly eight days on the market. much as the residential market. Whereas there is more demand than supply for homes and condos, in the land market the reverse is true. But if the supply of homes available for purchase continues to dwinde, then more buyers may decide to buy land and buld Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 08/24/2020. Data are believed to be accurate, but are not guaranteed.