Advertisement

-

Published Date

July 22, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

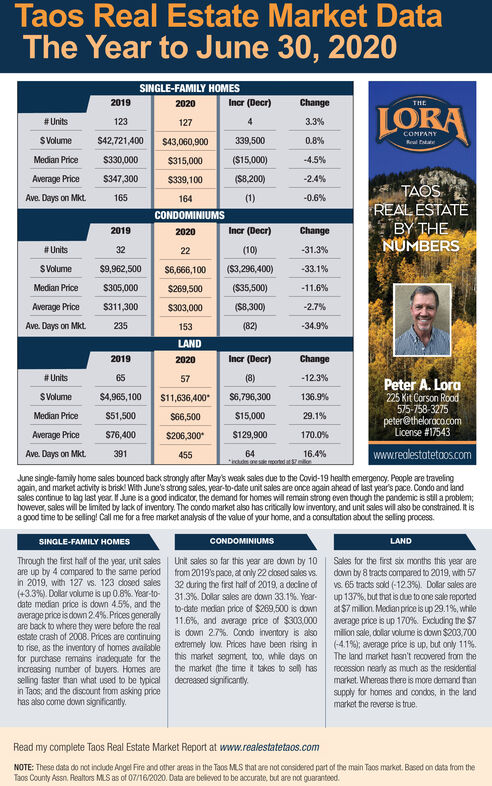

Taos Real Estate Market Data The Year to June 30, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE #Units 123 127 3.3% COMPANY Reul ta SVolume $42,721,400 $43,060,900 339,500 0.8% Median Price $330,000 $315,000 ($15,000) -4.5% Average Price $347,300 $339,100 ($8,200) -2.4% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 165 164 (1) -0.6% CONDOMINIUMS 2019 2020 Incr (Decr) Change #Units 32 22 (10) -31.3% SVolume $9,962,500 S6,666,100 (S3,296,400) -33.1% Median Price S305,000 $269,500 (S35,500) -11.6% Average Price $311,300 $303,000 ($8,300) -2.7% Ave. Days on Mkt. 235 153 (82) -34.9% LAND 2019 2020 Incr (Decr) Change # Units 65 57 (8) -12.3% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraco.com License #17543 SVolume $4,965, 100 $11,636,400 $6,796,300 136.9% Median Price $51,500 S66,500 $15,000 29.1% Average Price $76,400 $206,300* $129,900 170.0% Ave. Days on Mkt. 391 64 d e mott o www.realestatetaos.com 455 16.4% June single-family home sales bounced back strongly after May's weak sales due to the Covid-19 health emergency. People are traveling again, and market activity is brisk! With June's strong sales, year-to-date unit sales are once again ahead of last year's pace. Condo and land sales continue to kag last year. H June is a good indicator, the demand for homes will remain strong even though the pandemic is stil a problem; however, sales will be limited by lack of inventory. The condo market also has critically low inventory, and unit sales wil also be constrained. It is a good time to be selling! Call me for a free market analysis of the value of your home, and a consuitation about the selling process. SINGLE-FAMILY HOMES CONDOMINIUMS LAND Through the first half of the year, unit sales Unit sales so far this year are down by 10 are up by 4 compared to the same period from 2019's pace, at only 22 dosed sales vs. in 2019, with 127 vs. 123 dosed sales 32 during the first half of 2019, a docine of (+3.3%). Dollar volume is up 0.8%. Year-to- date median price is down 4.5%, and the average price is down 2.4%. Prices generally are back to where they were before the real estate crash of 2008. Prices are continuing to rise, as the inventory of homes available for purchase remains inadequate for the increasing number of buyers. Homes are selling faster than what used to be typical decreased significarty. in Taos; and the discount from asking price has also come down significantly. 31.3%. Dolar sales are down 33.1%. Year- to-date median prioe of $269,500 is down 11.6%, and average price of $303,000 is down 27%. Condo inventory is also extremely low. Prices have been rising in this market segment, too, while days on the market (the time it takes to sel) has Sales for the first six months this year are down by 8 tracts compared to 2019, with 57 vs 65 tracts sold (-123%). Dolar sales are up 137%, but that is due to one sale reported at $7 milion. Median price is up 29.1%, while average price is up 170%. Excluding the $7 milion sale, dollar volume is down $203,700 (-4.1%); average price is up, but only 11%. The land market hasn't recovered from the recession nearly as much as the residential market. Whereas there is more demand than supply for homes and condos, in the land market the reverse is true. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 07/16/2020. Data are believed to be accurate, but are not guaranteed. Taos Real Estate Market Data The Year to June 30, 2020 SINGLE-FAMILY HOMES 2019 2020 Incr (Decr) Change LORA THE #Units 123 127 3.3% COMPANY Reul ta SVolume $42,721,400 $43,060,900 339,500 0.8% Median Price $330,000 $315,000 ($15,000) -4.5% Average Price $347,300 $339,100 ($8,200) -2.4% TAOS REALESTATË BY THE NUMBERS Ave. Days on Mkt. 165 164 (1) -0.6% CONDOMINIUMS 2019 2020 Incr (Decr) Change #Units 32 22 (10) -31.3% SVolume $9,962,500 S6,666,100 (S3,296,400) -33.1% Median Price S305,000 $269,500 (S35,500) -11.6% Average Price $311,300 $303,000 ($8,300) -2.7% Ave. Days on Mkt. 235 153 (82) -34.9% LAND 2019 2020 Incr (Decr) Change # Units 65 57 (8) -12.3% Peter A. Lora 225 Kit Corson Rood 575-758-3275 peter@theloraco.com License #17543 SVolume $4,965, 100 $11,636,400 $6,796,300 136.9% Median Price $51,500 S66,500 $15,000 29.1% Average Price $76,400 $206,300* $129,900 170.0% Ave. Days on Mkt. 391 64 d e mott o www.realestatetaos.com 455 16.4% June single-family home sales bounced back strongly after May's weak sales due to the Covid-19 health emergency. People are traveling again, and market activity is brisk! With June's strong sales, year-to-date unit sales are once again ahead of last year's pace. Condo and land sales continue to kag last year. H June is a good indicator, the demand for homes will remain strong even though the pandemic is stil a problem; however, sales will be limited by lack of inventory. The condo market also has critically low inventory, and unit sales wil also be constrained. It is a good time to be selling! Call me for a free market analysis of the value of your home, and a consuitation about the selling process. SINGLE-FAMILY HOMES CONDOMINIUMS LAND Through the first half of the year, unit sales Unit sales so far this year are down by 10 are up by 4 compared to the same period from 2019's pace, at only 22 dosed sales vs. in 2019, with 127 vs. 123 dosed sales 32 during the first half of 2019, a docine of (+3.3%). Dollar volume is up 0.8%. Year-to- date median price is down 4.5%, and the average price is down 2.4%. Prices generally are back to where they were before the real estate crash of 2008. Prices are continuing to rise, as the inventory of homes available for purchase remains inadequate for the increasing number of buyers. Homes are selling faster than what used to be typical decreased significarty. in Taos; and the discount from asking price has also come down significantly. 31.3%. Dolar sales are down 33.1%. Year- to-date median prioe of $269,500 is down 11.6%, and average price of $303,000 is down 27%. Condo inventory is also extremely low. Prices have been rising in this market segment, too, while days on the market (the time it takes to sel) has Sales for the first six months this year are down by 8 tracts compared to 2019, with 57 vs 65 tracts sold (-123%). Dolar sales are up 137%, but that is due to one sale reported at $7 milion. Median price is up 29.1%, while average price is up 170%. Excluding the $7 milion sale, dollar volume is down $203,700 (-4.1%); average price is up, but only 11%. The land market hasn't recovered from the recession nearly as much as the residential market. Whereas there is more demand than supply for homes and condos, in the land market the reverse is true. Read my complete Taos Real Estate Market Report at www.realestatetaos.com NOTE: These data do not include Angel Fire and other areas in the Taos MLS that are not considered part of the main Taos market. Based on data from the Taos County Assn. Realtors MLS as of 07/16/2020. Data are believed to be accurate, but are not guaranteed.