Advertisement

-

Published Date

January 4, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

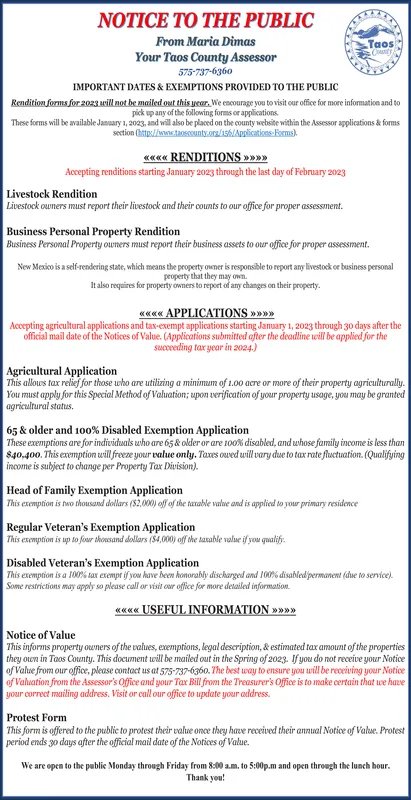

NOTICE TO THE PUBLIC From Maria Dimas Your Taos County Assessor 575-737-6360 IMPORTANT DATES & EXEMPTIONS PROVIDED TO THE PUBLIC Rendition forms for 2023 will not be mailed out this year. We encourage you to visit our office for more information and to pick up any of the following forms or applications. These forms will be available January 1, 2023, and will also be placed on the county website within the Assessor applications & forms section (http://www.taoscounty.org/156/Applications Forms) **** RENDITIONS »»»» Accepting renditions starting January 2023 through the last day of February 2023 Livestock Rendition Livestock owners must report their livestock and their counts to our office for proper assessment. Taos Charity Business Personal Property Rendition Business Personal Property owners must report their business assets to our office for proper assessment. New Mexico is a self-rendering state, which means the property owner is responsible to report any livestock or business personal property that they may own. It also requires for property owners to report of any changes on their property. ««««< APPLICATIONS >>>>> Accepting agricultural applications and tax-exempt applications starting January 1, 2023 through 30 days after the official mail date of the Notices of Value. (Applications submitted after the deadline will be applied for the succeeding tax year in 2024.) Agricultural Application This allows tax relief for those who are utilizing a minimum of 1.00 acre or more of their property agriculturally. You must apply for this Special Method of Valuation; upon verification of your property usage, you may be granted agricultural status. 65 & older and 100% Disabled Exemption Application These exemptions are for individuals who are 65 & older or are 100% disabled, and whose family income is less than $40.400. This exemption will freeze your value only. Taxes owed will vary due to tax rate fluctuation. (Qualifying income is subject to change per Property Tax Division). Head of Family Exemption Application This exemption is two thousand dollars ($2,000) off of the taxable value and is applied to your primary residence Regular Veteran's Exemption Application This exemption is up to four thousand dollars ($4,000) off the taxable value if you qualify Disabled Veteran's Exemption Application This exemption is a 100% tax exempt if you have been honorably discharged and 100% disabled permanent (due to service). Some restrictions may apply so please call or visit our office for more detailed information **** USEFUL INFORMATION >>>>>> Notice of Value This informs property owners of the values, exemptions, legal description, & estimated tax amount of the properties they own in Taos County. This document will be mailed out in the Spring of 2023. If you do not receive your Notice of Value from our office, please contact us at 575-737-6360. The best way to ensure you will be receiving your Notice of Valuation from the Assessor's Office and your Tax Bill from the Treasurer's Office is to make certain that we have your correct mailing address. Visit or call our office to update your address. Protest Form This form is offered to the public to protest their value once they have received their annual Notice of Value. Protest period ends 30 days after the official mail date of the Notices of Value. We are open to the public Monday through Friday from 8:00a.m. to 5:00p.m and open through the lunch hour. Thank you! NOTICE TO THE PUBLIC From Maria Dimas Your Taos County Assessor 575-737-6360 IMPORTANT DATES & EXEMPTIONS PROVIDED TO THE PUBLIC Rendition forms for 2023 will not be mailed out this year . We encourage you to visit our office for more information and to pick up any of the following forms or applications . These forms will be available January 1 , 2023 , and will also be placed on the county website within the Assessor applications & forms section ( http://www.taoscounty.org/156/Applications Forms ) **** RENDITIONS » » » » Accepting renditions starting January 2023 through the last day of February 2023 Livestock Rendition Livestock owners must report their livestock and their counts to our office for proper assessment . Taos Charity Business Personal Property Rendition Business Personal Property owners must report their business assets to our office for proper assessment . New Mexico is a self - rendering state , which means the property owner is responsible to report any livestock or business personal property that they may own . It also requires for property owners to report of any changes on their property . « « « « < APPLICATIONS >>>>> Accepting agricultural applications and tax - exempt applications starting January 1 , 2023 through 30 days after the official mail date of the Notices of Value . ( Applications submitted after the deadline will be applied for the succeeding tax year in 2024. ) Agricultural Application This allows tax relief for those who are utilizing a minimum of 1.00 acre or more of their property agriculturally . You must apply for this Special Method of Valuation ; upon verification of your property usage , you may be granted agricultural status . 65 & older and 100 % Disabled Exemption Application These exemptions are for individuals who are 65 & older or are 100 % disabled , and whose family income is less than $ 40.400 . This exemption will freeze your value only . Taxes owed will vary due to tax rate fluctuation . ( Qualifying income is subject to change per Property Tax Division ) . Head of Family Exemption Application This exemption is two thousand dollars ( $ 2,000 ) off of the taxable value and is applied to your primary residence Regular Veteran's Exemption Application This exemption is up to four thousand dollars ( $ 4,000 ) off the taxable value if you qualify Disabled Veteran's Exemption Application This exemption is a 100 % tax exempt if you have been honorably discharged and 100 % disabled permanent ( due to service ) . Some restrictions may apply so please call or visit our office for more detailed information **** USEFUL INFORMATION >>>>>> Notice of Value This informs property owners of the values , exemptions , legal description , & estimated tax amount of the properties they own in Taos County . This document will be mailed out in the Spring of 2023. If you do not receive your Notice of Value from our office , please contact us at 575-737-6360 . The best way to ensure you will be receiving your Notice of Valuation from the Assessor's Office and your Tax Bill from the Treasurer's Office is to make certain that we have your correct mailing address . Visit or call our office to update your address . Protest Form This form is offered to the public to protest their value once they have received their annual Notice of Value . Protest period ends 30 days after the official mail date of the Notices of Value . We are open to the public Monday through Friday from 8:00 a.m . to 5:00 p.m and open through the lunch hour . Thank you !