Advertisement

-

Published Date

May 18, 2022This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

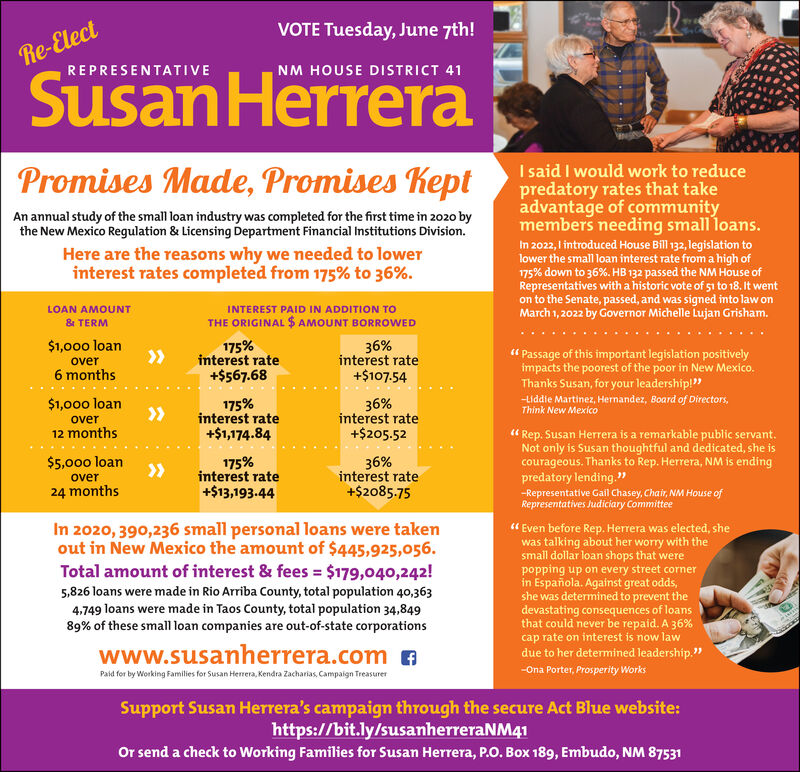

VOTE Tuesday, June 7th! Re-Elect REPRESENTATIVE NM HOUSE DISTRICT 41 Promises Made, Promises Kept I said I would work to reduce predatory rates that take advantage of community members needing small loans. An annual study of the small loan industry was completed for the first time in 2020 by the New Mexico Regulation & Licensing Department Financial Institutions Division. Here are the reasons why we needed to lower interest rates completed from 175% to 36%. In 2022, I introduced House Bill 132, legislation to lower the small loan interest rate from a high of 175% down to 36%. HB 132 passed the NM House of Representatives with a historic vote of 51 to 18. It went on to the Senate, passed, and was signed into law on March 1, 2022 by Governor Michelle Lujan Grisham. LOAN AMOUNT INTEREST PAID IN ADDITION TO THE ORIGINAL $ AMOUNT BORROWED & TERM $1,000 loan over 175% interest rate +$567.68 36% interest rate +$107.54 6 months "Passage of this important legislation positively impacts the poorest of the poor in New Mexico. Thanks Susan, for your leadership!" $1,000 loan 36% -Liddie Martinez, Hernandez, Board of Directors, Think New Mexico over 175% interest rate +$1,174.84 12 months interest rate +$205.52 $5,000 loan 175% interest rate +$13,193.44 over "Rep. Susan Herrera is a remarkable public servant. Not only is Susan thoughtful and dedicated, she is courageous. Thanks to Rep. Herrera, NM is ending predatory lending." 36% interest rate +$2085.75 24 months -Representative Gail Chasey, Chair, NM House of Representatives Judiciary Committee In 2020, 390,236 small personal loans were taken out in New Mexico the amount of $445,925,056. Total amount of interest & fees = $179,040,242! 5,826 loans were made in Rio Arriba County, total population 40,363 4,749 loans were made in Taos County, total population 34,849 89% of these small loan companies are out-of-state corporations "Even before Rep. Herrera was elected, she was talking about her worry with the small dollar loan shops that were popping up on every street corner in Española. Against great odds, she was determined to prevent the devastating consequences of loans that could never be repaid. A 36% cap rate on interest is now law due to her determined leadership." -Ona Porter, Prosperity Works www.susanherrera.com Paid for by Working Families for Susan Herrera, Kendra Zacharias, Campaign Treasurer Support Susan Herrera's campaign through the secure Act Blue website: https://bit.ly/susanherreraNM41 Or send a check to Working Families for Susan Herrera, P.O. Box 189, Embudo, NM 87531 VOTE Tuesday , June 7th ! Re - Elect REPRESENTATIVE NM HOUSE DISTRICT 41 Promises Made , Promises Kept I said I would work to reduce predatory rates that take advantage of community members needing small loans . An annual study of the small loan industry was completed for the first time in 2020 by the New Mexico Regulation & Licensing Department Financial Institutions Division . Here are the reasons why we needed to lower interest rates completed from 175 % to 36 % . In 2022 , I introduced House Bill 132 , legislation to lower the small loan interest rate from a high of 175 % down to 36 % . HB 132 passed the NM House of Representatives with a historic vote of 51 to 18. It went on to the Senate , passed , and was signed into law on March 1 , 2022 by Governor Michelle Lujan Grisham . LOAN AMOUNT INTEREST PAID IN ADDITION TO THE ORIGINAL $ AMOUNT BORROWED & TERM $ 1,000 loan over 175 % interest rate + $ 567.68 36 % interest rate + $ 107.54 6 months " Passage of this important legislation positively impacts the poorest of the poor in New Mexico . Thanks Susan , for your leadership ! " $ 1,000 loan 36 % -Liddie Martinez , Hernandez , Board of Directors , Think New Mexico over 175 % interest rate + $ 1,174.84 12 months interest rate + $ 205.52 $ 5,000 loan 175 % interest rate + $ 13,193.44 over " Rep . Susan Herrera is a remarkable public servant . Not only is Susan thoughtful and dedicated , she is courageous . Thanks to Rep . Herrera , NM is ending predatory lending . " 36 % interest rate + $ 2085.75 24 months -Representative Gail Chasey , Chair , NM House of Representatives Judiciary Committee In 2020 , 390,236 small personal loans were taken out in New Mexico the amount of $ 445,925,056 . Total amount of interest & fees = $ 179,040,242 ! 5,826 loans were made in Rio Arriba County , total population 40,363 4,749 loans were made in Taos County , total population 34,849 89 % of these small loan companies are out - of - state corporations " Even before Rep . Herrera was elected , she was talking about her worry with the small dollar loan shops that were popping up on every street corner in Española . Against great odds , she was determined to prevent the devastating consequences of loans that could never be repaid . A 36 % cap rate on interest is now law due to her determined leadership . " -Ona Porter , Prosperity Works www.susanherrera.com Paid for by Working Families for Susan Herrera , Kendra Zacharias , Campaign Treasurer Support Susan Herrera's campaign through the secure Act Blue website : https://bit.ly/susanherreraNM41 Or send a check to Working Families for Susan Herrera , P.O. Box 189 , Embudo , NM 87531